Retail traders and investors often don’t get the credit they deserve. But in April, they showed they’ve got serious market smarts.

While headlines screamed about a tanking stock market — remember, post-Liberation Day— retail investors waited patiently. And when the time felt right, they jumped in, adding $40 billion to the stock market during the month. Just this past Monday, retail investors poured another $5.4 billion in by day’s end. That was more than a third of the day’s trading volume!

If this keeps up, May could beat April in terms of total inflows.

Lessons From the Past

Many of you probably remember the dot-com boom and the painful bust that followed. A lot of retail traders jumped in thinking they were buying the dip. Unfortunately, the market had other plans. Many retail traders got wiped out because they ended up buying at the peak rather than the dip.

This is the risk “buy the dip” buyers face. Sometimes it works. Sometimes it doesn’t. So, how do you protect your portfolio value, especially now that you’re managing some of your investments?

Start With a Simple Daily Routine

Taking control of your finances doesn’t mean you need to stare at a screen all day. But checking in on the market regularly can go a long way. Even a quick peek at the Market Summary page at the end of each day (or once a week) can help you stay on track.

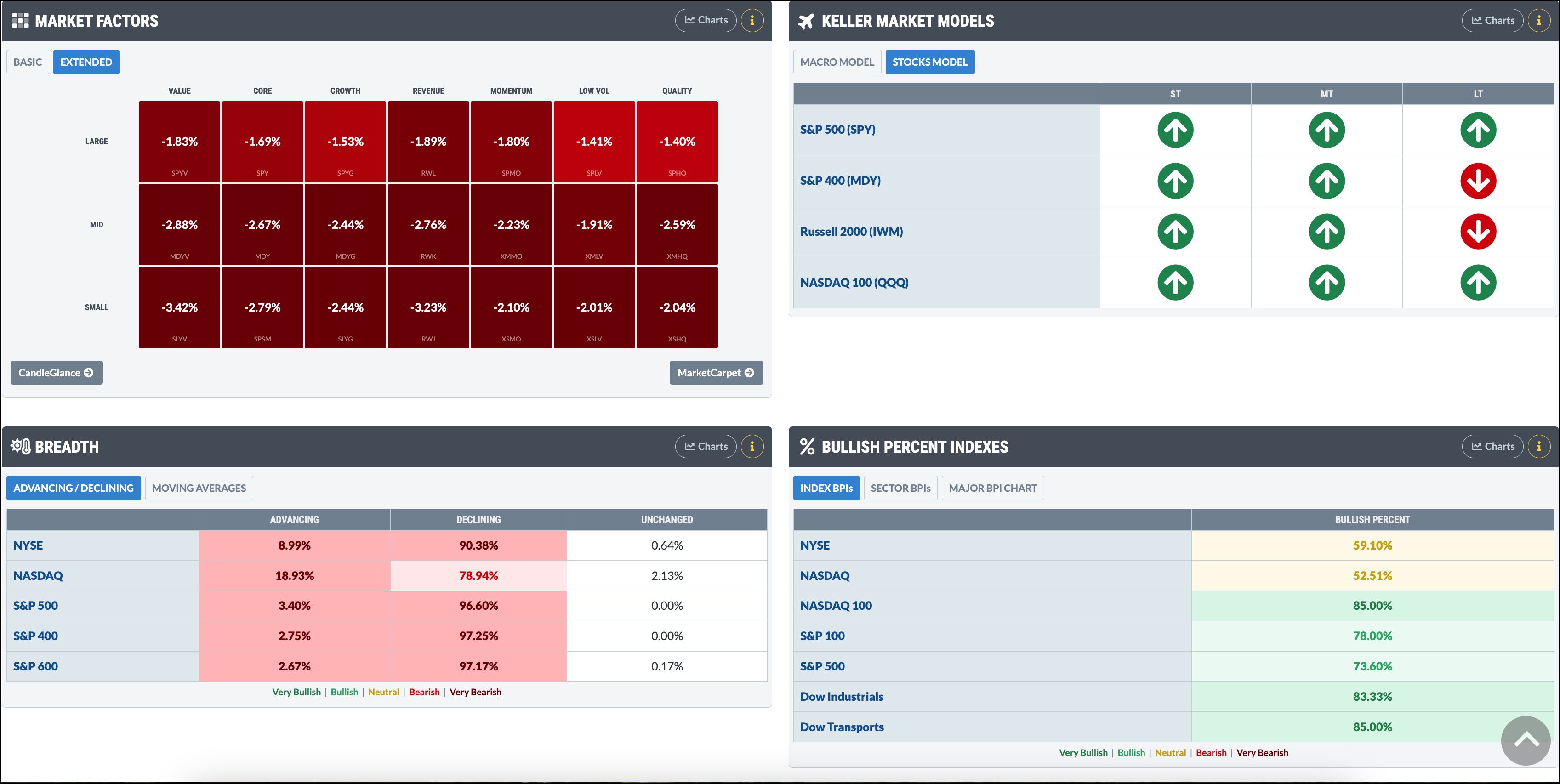

You’ll get a snapshot of how the major indexes are performing, what their daily or weekly streaks are, and if they are above specific moving averages. Here’s a little snippet of the page. There’s a lot more to discover on the page.

An Example: Keeping Tabs on NVIDIA (NVDA)

Let’s say you bought shares of NVIDIA Corp. (NVDA) after it dipped in early April. Despite how well the stock performed in 2024, you can’t just “set it and forget it.”

You will want to monitor how the S&P 500 ($SPX), Nasdaq ($COMPQ), and Nasdaq 100 ($NDX) are performing since NVDA is a heavily weighted stock in these indexes.

Here’s what you can do:

- Check the trend. Are the indexes trending higher? Are they above key moving averages?

- Click on the index name. Start with the daily chart and look for any red flags like a break below the 200-day simple moving average (SMA).

- Watch the up or down streaks. If a winning streak turns into a losing one, it’s worth noting.

Digging Deeper With Internals and Sector Insights

The Market Summary page also gives you access to market internals that can help you determine the health of the indexes. These include the Advancing/Declining Issues, Bullish Percent Index (BPI), and New Highs/New Lows, among many others.

Since your focus is semiconductor stocks, you would closely watch the related indexes. For BPI, you’d go one step further and monitor the Technology Sector BPI ($BPINFO).

The US Industries panel displays the performance of the Semiconductors.

What’s Up With Semis? Let’s Look at XSD

At this point, it’s worth analyzing the chart of the SPDR S&P Semiconductor ETF (XSD), the ETF included in the Market Summary page. The six-month daily chart below shows that XSD is now trading below its 200-day SMA, which is a reason for concern.

FIGURE 1. DAILY CHART OF XSD. The ETF fell below its 200-day SMA on Wednesday and is underperforming SPY. Chart source: StockCharts.com. For educational purposes.

Note that XSD is holding on to the support of the May 12 low, which is when the price gapped up. Gaps often get filled, so a fall below where XSD closed on Wednesday could take the ETF down to the $210 level.

In addition, the ETF’s performance relative to the S&P 500 ETF (SPY) over the last six months is at -3.96%. This indicates that semiconductors are trying hard to re-establish their pre-2025 leadership position. If XSD continues to underperform SPY, it would be more reason to be concerned.

Check In on NVDA Again

Seeing this chart should prompt you to pull up the chart of NVDA. Is the stock following the same pattern as the ETF?

Looking at the six-month daily chart of NVDA, it’s still above its 200-day SMA, unlike XSD. However, NVDA’s stock price is flirting with the support of its May 14 low. A breach of the low could take NVDA’s stock price to its 200-day SMA or lower. This wouldn’t be good for the overall equity market because NVDA is such a heavyweight in the U.S. large-cap indexes.

FIGURE 2. DAILY CHART OF NVDA STOCK. Wednesday’s price action suggests the possibility of a pullback. If price falls below the May 14 low, the next stop could be the 200-day SMA. Chart source: StockCharts.com. For educational purposes.

Before entering your position, you should have identified your profit target and exit point based on your risk tolerance level. Remember, when managing your investments, discipline is key.

Keep It Simple

The Market Summary page is a tool that can help you stay ahead of the stock market without overwhelming you.

Here is one way to use the Market Summary page:

- You don’t need to be glued to the screen. Just make checking in a part of your routine.

- Know what matters. Focus on the key indexes, which direction they are trending, and the sectors you’re invested in.

- Engage with the market. The more you understand the price action of the market, the more empowered you become.

There are many more ways to use the Market Summary page, and we’ll be sharing more in upcoming articles.

Bottom Line

Whether you’re hands-on with your investments, semi-retired, or retired, staying informed can help you feel confident and in control.

So go on, check out the Market Summary page, explore the charts, and stick to your trading plan.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.